Investments!! One of the buzzing topics of discussion among young adults is an investment. Where to invest? How to invest? and most importantly when to invest are the questions everyone needs answers for. In this blog, we will try to find out why investment experts say “you are never too early for investing”.

In your early 20’s when you start your first job and you are generating income, then, that is the right time for investment. You might think a year’s delay is not so bad, but it can make some serious impacts on your wealth management. Here are the top reasons why investing early makes a big difference.

Compounding:

Albert Einstein said, “Compounding is the eighth wonder of the world”. It indeed is!

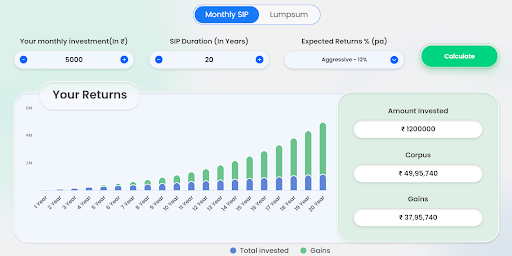

Let’s say you want to build a wealth of Rs.50 lakhs in 20 years. Then you might want to invest in mutual funds with 12% expected returns with a monthly SIP of Rs.5,000. This investment, over 20 years will give you a return of Rs. 50 Lakhs.

But when you start your investment later, in 19 years, you’ll be able to accumulate only Rs.43 lakhs. Waiting for just one year to start your investment can make a change of Rs.7 lakhs to your portfolio.

This is the power of compounding. Therefore, starting early can give you more returns in the end.

Check your spending habits:

When you generate a fixed income in your early 20s, it is important to save a fixed percentage for your future spending and goals. But, the new promotion and products launched in the market might encourage you to spend your money on unnecessary things. A regular investing habit in a Mutual fund through a SIP can build a disciplined financial habit. Putting aside a fixed amount every month for savings can help you build your wealth. Starting this habit as early as possible can be very beneficial in the long run.

Longer investment tenure = Smaller investment amount

As you are starting your investment at a young age, you have a longer tenure to save towards your goals. And therefore, the investment amount becomes smaller. Let’s say you are saving Rs. 1 crore for your retirement. If you start at the age of 25, a monthly SIP of Rs. 3000 for 30 years at a 12% return rate can generate your desired corpus.

But when you start at the age of 35, you have to start a monthly SIP of Rs. 10,000 to get the same corpus. Hence, the investment amount is larger when you start late. The same applies for your different goals.

Whatever your goals are, starting an early investing habit can make big changes to your wealth creation.

Save taxes:

We all pay taxes in different forms. Be it a professional tax or income tax, we all pay a certain amount to the government. Every gain in your investments is taxed. However, with investment in Equity Linked Saving Schemes (ELSS), you can save on taxes. This type of Mutual fund has the benefit of tax savings. Under the income tax act, 1961 section 80C, you can save up to Rs. 1.5 lakhs with ELSS investments. Therefore, regular ELSS investment from a younger age provides you the tax-saving options immediately after you start earning your first regular income. This, in the long term, can save you a lot of taxes on a regular basis.

Increasing wealth:

Investing early is very important in generating wealth. A regular disciplined investment periodically can increase your wealth exponentially. Even an investment of Rs. 1000 on SIPs monthly can generate huge wealth. Due to the greater recovery period, you can also invest in high-risk investments and can double your savings. If you try to catch up on your savings after skipping them for years, then you might want to invest an increased sum regularly with a lesser risk appetite. Hence, investing early can be very beneficial for long-term as well as short-term goals. Whatever may be your plans, regular investment can help you achieve them.

The bottom line:

The earlier you start, the easier it is for you to build your wealth. It might feel so exhausting and intimidating to start investing at an early age as you will not have enough cash flow for investing. Don’t wait to accumulate enough money for large investments. Start with monthly SIPs and wait for your money to mature. Investing a large amount after skipping investments for years is not going to bridge the gap. Try to increase your time in the market and multiply your money. Always feel free to contact financial advisors and get your doubts cleared before starting your investment journey. Make use of your biggest asset – Your youth and time and start investing early!!

| Homepage | Click Hear |