Credit card debt is not just a number. It reflects the money habits and struggles of millions of Americans. On average, Americans owe $6,194 on credit cards. That’s according to a 2019 credit report.

Credit card debt has grown a lot over the years. More and more people rely on plastic for purchases. But credit card interest and fees can pile up fast. This makes debt stressful and hard to pay off.

Different states have different levels of credit card debt. Which states owe the most on their cards? And what drives debt in each area? Let’s explore credit card debt across America and what it means. The following charts show how debt stacks up state by state.

State-by-State Breakdown: The Top 10 States with the Highest Credit Card Debt

When we zoom in on individual states, the disparities in credit card balances become evident. Alaskans, for instance, have the highest credit card balance, averaging $8,026. But how do other states compare?

For a comprehensive look at state-level credit card debt rankings, check out this report on state-level credit card debt rankings. It provides great detail on the top debt-burdened states.

Factors Influencing High Debt in Certain States

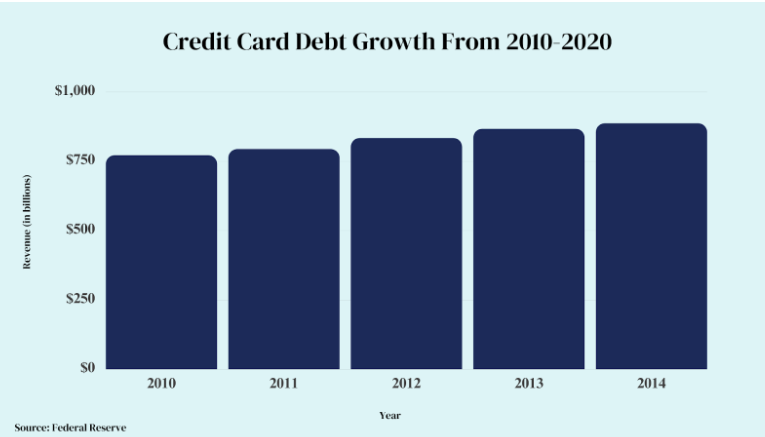

Several elements, from economic conditions to individual financial behaviors, influence the credit card debt landscape in each state. It’s noteworthy that U.S. credit card debt reached a record high of $930 billion in the final quarter of 2019, according to a report. Look at the data below to understand the growth of credit card debt over the past years:

States like Alaska, New Jersey, and Connecticut that top the rankings tend to have higher costs of living that drive up expenses and debt. For instance, the cost of living in Alaska is 31% higher than the national average, largely due to expensive housing and food costs from the remote location and harsh climate. Residents in wealthy urban areas like the District of Columbia and Hawaii also see inflated prices for goods and services.

On the other hand, states like Montana, Wyoming, and New Mexico that rank near the bottom have lower costs of living but are prone to job loss or stagnating wages that make debt payments challenging. Rural areas in states like Iowa and North Dakota also struggle with underemployment and fewer stable job opportunities outside of agriculture and manufacturing.

Additionally, the financial literacy levels and money management skills of residents contribute to debt patterns. Younger populations in states like Utah and North Dakota may lack experience handling debt and credit cards compared to older demographics elsewhere. A Federal Reserve study found only 57% of adults could correctly calculate interest on a loan, indicating poor financial literacy nationwide.

Cultural attitudes and social norms around finance also come into play. In states like Wisconsin and Minnesota, frugality and conscientious spending are ingrained more, leading to lower debt usage. In contrast, East Coast states with expensive lifestyles like New York and New Jersey see debt as more acceptable and commonplace.

Repayment Strategies and Their Effectiveness

Managing credit card debt is a challenge, but with the right strategy, it’s a surmountable one. Consider this: If the average American with a $6,194 balance on their credit card pays $200 each month, they’d spend over three years and an additional $2,012 in interest to clear that debt.

Two common repayment strategies include:

-

Avalanche Method:

Focus on paying off the card with the highest interest rate first, while making minimum payments on the others. This method can save the most money on interest payments over time. For instance, focusing an extra $100 per month on a card with a 25% APR can eliminate it years faster than making even payments across multiple cards.

-

Snowball Method:

Focus on paying off the card with the smallest balance first, before moving to larger ones. This gives motivation through small quick wins. Knocking out a $500 balance fast offers encouragement to tackle the next smallest debt. However, interest costs may be higher overall with this method.

The avalanche method is often more effective mathematically, saving consumers money through reduced interest. However, the snowball method’s psychological boosts can also keep people motivated. Ultimately, picking a structured plan and sticking to it is key.

Additional strategies like balance transfers to low or 0% introductory APR cards, consolidating into lower-rate personal loans, and enrolling in non-profit debt management programs can provide other avenues to become debt-free. With commitment and consistency, consumers can take control of their debt situation.

Frequently Asked Questions

- Why do some states have significantly higher credit card debt than others?

Factors like cost of living, economic conditions, incomes, financial literacy, and spending habits influence debt levels across states. Wealthy regions and urban areas tend to have higher debt, while rural areas with stagnant wages or underemployment struggle too.

- How do interest rates vary across states, and how do they impact the overall debt?

Interest rates are generally similar across states but can vary based on credit scores. Higher interest rates make it harder to pay off debt, leading to more overall interest costs. Consumers should comparison shop for low introductory offers.

- What are the long-term implications of prolonged credit card debt for individuals and the economy at large?

For individuals, high credit card debt strains budgets and makes it hard to save or reach other goals. It can lower credit scores and interest rates for future loans. For the wider economy, high consumer debt dampens spending power and economic growth. It’s vital to address excessive debt.

Conclusion

In summary, credit card debt patterns across the United States offer insights into the financial psyche of consumers nationwide. While averages provide a big-picture perspective, analyzing state-specific figures reveals intriguing variations based on economic, demographic, and behavioral factors unique to each area. By understanding the drivers of debt and practicing consistent repayment strategies, consumers can take control of their finances and build for a more secure future.

| Homepage | Click Hear |