A credit card is a payment card issued to users (cardholders) that enables the cardholder to pay to a merchant for goods and services based on the cardholder’s accrued debt (i.e., along with the amount to them from the card issuer). promises to pay other agreed charges) ). The card issuer (usually a bank) creates a revolving account and gives the cardholder a line of credit, allowing the cardholder to pay to a merchant or cash advance As money can be borrowed.

A credit card differs from a charge card in that the balance has to be paid off in full each month or at the end of each statement cycle. In contrast, credit cards allow consumers to build up an ongoing balance of the debt. which is subject to interest. A credit card differs from a charge card in that a credit card typically involves a third-party entity that pays the seller and is reimbursed by the buyer, whereas a charge card is made by the buyer at a later date. Postpones payment.

A credit card also differs from a cash card in that it can be used as currency by the owner of the card.

In 2018, U.S. There were 1.12 billion credit cards in circulation in the U.S., and 72% of adults had at least one card.

Technical specifications

Most credit cards have rounded corners with a size of 85.60 by 53.98 millimeters (3+3⁄8 in × 2+1⁄8 in) and a radius of 2.88–3.48 millimeters (9⁄80–11⁄80 in). Similar in size to other payment cards such as ATM cards and debit cards, compliant with ISO/IEC 7810 ID-1 standard.

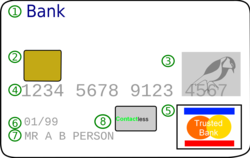

Credit cards have a printed or embossed bank card number complying with the ISO/IEC 7812 numbering standard. The prefix of the card number, called the bank identification number (known in the industry as BIN ), is the sequence of digits at the beginning of the number that determines the bank to which the credit card number belongs. These is the first six digits for MasterCard and Visa cards. The next nine digits are the personal account number, and the last digit is a validity check code.

Both these standards are maintained and further developed by ISO/IEC JTC 1/SC17/WG1. Credit cards have a magnetic stripe compliant with ISO/IEC 7813. Most modern credit cards use smart card technology: they have a computer chip embedded in them as a security feature. In addition, complex smart cards are increasingly being used for credit cards, including peripherals such as keypads, displays, or fingerprint sensors.

In addition to the main credit card number, credit cards have an issue and expiration dates (given to the nearest month), as well as additional codes such as issue numbers and security codes. Complex smart cards allow a variable security code, thus increasing the security for online transactions. Not all credit cards have the same set of additional codes nor do they use the same number of digits.

The credit card number was originally embossed so that the number could be easily transferred to the charge slip. With the decline of paper slips, some credit cards are no longer embossed and in fact, the card number is no longer on the front. [9] In addition, some cards are now vertical in design rather than horizontal.

Also Read: credit card generator India

Minimum payment

The Cardholder must pay a specified minimum portion of the outstanding balance by the due date or may choose to pay a higher amount. If the billed amount is not paid in full, the credit issuer charges interest on the unpaid balance (usually at a much higher rate than most other forms of credit). In addition, if the cardholder fails to make at least the minimum payment by the due date, the issuer may levy a late fee or other penalties. To help mitigate this, some financial institutions may arrange for automatic payments to be deducted from the cardholder’s bank account, thus avoiding such penalties altogether, as long as the cardholder has sufficient funds.

In cases where the minimum payment is less than the fixed finance charges and charges during the billing cycle, the amount outstanding will increase which is referred to as negative amortization. This practice increases credit risk and conceals the quality of the lender’s portfolio, and has resulted in U.S. debt since 2003. banned in.

Credit card register

A credit card register is a transaction register that is used to ensure that the amount owed using a credit card is well below the credit limit, from the authorization holding and payments not yet received by the bank. Easy to view past transactions for handling and reconciliation and budgeting.

A register is a personal record of banking transactions used for credit card purchases as they affect funds in a bank account or available credit. In addition to the check number, the code column shows the credit card. The Balance column shows the funds available after purchase. When paying with a credit card the balance already shows that the money was spent. In the credit card entry, the Deposit column shows the available credits and the Payment column shows the total outstanding, their amount equal to the credit limit.

Every written check, debit card transaction, cash withdrawal, and credit card fee is manually entered in the paper register daily or several times per week. A credit card register also refers to a transaction record for each credit card. In the case when ten or more cards are in use, the booklets simply enable the location of the card’s currently available credit.

Credit cards as funding for entrepreneurs

Credit cards are a risky way for entrepreneurs to acquire capital for their start-ups when more traditional financing is not available. Len Bosack and Sandy Lerner used personal credit cards to start Cisco Systems. Larry Page and Sergey Brin’s Google startup was financed by credit cards to purchase necessary computers and office equipment, specifically “terabytes of hard disks”. Similarly, filmmaker Robert Townsend financed part of the Hollywood Shuffle using a credit card.

Director Kevin Smith partially funded the clerks by maxing out several credit cards. Actor Richard Hatch financed the production of Battlestar Galactica: The Second Coming, partly through his credit card. Renowned hedge fund manager Bruce Kovner began his career in the financial markets (and later, his firm Caxton Associates) by borrowing from his credit card. UK entrepreneur James Caan (as seen on Dragons Den) financed his first business using multiple credit cards.

Also Read: राजधानी नाइट चार्ट

| Homepage | Click Hear |